If you’re a homeowner living in a hot rental market you might be wondering, is a granny flat a good investment? Building a 2nd rentable unit gives homeowners a lot of flexibility and financial freedom, but before you commit to anything you should consider the following things.

Here’s how to analyze if a granny flat is a good investment.

A granny flat is a good investment if:

- You plan to own the home long-term and can rent it for many years.

- You already own the land because the rent to cost ratio is very favorable.

- There’s no owner occupancy clause forcing you to stay on the property.

- You have home equity or access to capital to build.

- The rental market is hot and will likely continue that way for the foreseeable future.

- Building a granny flat is a good lifestyle fit.

If you can answer yes to these, take the first step by downloading our free tool kit, filled with the information you need to get started.

How Long Do You Plan to Own Your Home?

Granny flats are solid long-term investments. They aren’t ideal for flips or get rich quick schemes. In fact, one architecture firm estimates that adjusting for inflation a granny flat generates 2 million dollars in value to a homeowner over a 30 year period.

We had a San Diego homeowner reach out with this dilemma.

Scenario: “I’m thinking about building an accessory dwelling unit on my property in North Park (San Diego). I own a three bedroom one bath craftsman on a large lot. I’m worried about the permitting process and wondering if it’s worth it to build a granny flat or if I should save a few more years and buy a single family home?”

Let’s evaluate this by exploring a rent to cost ratio.

Rent to Cost Ratio

Typically because the land is already purchased the rent to cost is very good on an accessory dwelling unit compared to buying a new property. The rent to cost ratio has a direct correlation with cash flow; all things equal, the property with the better rent to cost ratio will have the better cash flow.

Calculate the rent to cost ration by dividing the value of the home to the annual rental rates.

Home Value ÷ (12 x Rental Rate) = Rent to Cost Ratio

Seeing that the land is already owned, it would be easier to achieve a higher rent to cost ratio by building an accessory dwelling unit vs. buying a single-family residence.

Let’s look at the next steps when considering if a granny flat is a good investment.

Is Building a Granny Flat Legal?

Many people decide these units are so valuable that they build them illegally if the law isn’t favorable to granny flats. In many parts of the country, building a granny flat simply isn’t possible with current legislation. In fact, there are an estimated 50,000 illegal granny flats in Los Angeles alone.

“When homeowners go to sell with an illegal granny flat on the property that gives buyers an uh-oh feeling. Instead of being excited to have a granny flat on the property they’re much more apprehensive,” said Daniel Aguilar, owner of New Reality Real Estate.

It’s all about perceived value. Plus Aguilar added, “It can be a liability.”

Luckily for homeowners in California, Portland, and Austin, recent changes to legislation are not only making the construction possible it’s also relaxing the fees involved.

When building without a permit, you risk code enforcement fines or may have to tear down the structure. Some cities, however, are allowing homeowners to apply to bring illegal units up to code and receive a permit. Check out our article on how to legalize your unit.

Often building a unit illegally causes a problem when a homeowner goes to sell their house.

What Ordinances Are in Place?

If you can legally build a granny flat, then you can start exploring the local ordinance. Each jurisdiction has its own ordinance that dictates things like:

- Where you can build

- How big the lot size must be

- Setback requirements

- If parking must be provided

- How small or large you can build

and a laundry list of other things.

One rule to keep an eye out for is owner occupancy. If your jurisdiction requires owner occupancy that means you must live either on the main property or in the granny flat. Depending on a homeowner’s long-term goals this might be a deal breaker.

If zoning restrictions are in place that makes it illegal to build some homeowners go to the city and seek a variance. Applying does not guarantee that you’ll receive it, but cities that are behind on housing development quotas may be more willing to make exceptions.

What Does the Rental Market Look Like?

Estimate how much monthly income you can make off renting your granny flat. You can use sites like Craigslist and Zillow to look at what comparable units rent for in your neighborhood.

Keep in mind that granny flats that are free standing tend to be more desirable for renters and can usually charge slightly more than an apartment building. This is especially true if the granny flat comes with garden or outdoor space that renters in apartment buildings rarely have access to.

Another way to gauge the market is to look at the rental vacancy rate. The rental vacancy rate is the fraction of homes for rent that is not occupied. The vacancy rate is the critical index of what will happen to rent and prices. Landlords can raise their rents in a market where you have extremely low vacancy rates.

This is happening in places like:

- San Francisco – 2.34% vacancy rate

- San Diego – 3.3% vacancy rate

- Downtown Los Angeles – 12% vacancy rate (Greater LA is 4%)

- Portland – 3.4% vacancy rate

- Austin – 7.8% vacancy rate

A healthy market should have a 7% vacancy rate. Anything lower than that suggests that there aren’t enough units to rent.

How Much Does a Granny Flat Cost?

Homeowners tend to dramatically underestimate the cost of building a granny flat. Click here to download the Cost Estimator Cheat Sheet. It’ll walk you through itemized building costs and estimates for a garage conversion, stand-alone unit, as well as a basement conversion.

Generally speaking, homeowners should estimate $200-300 per square foot. That number will be closer to $300 per square foot if you are building a second story or above a garage.

Homeowners should take into account:

- Permitting fees $5-30K (this varies dramatically based on location)

- Design fees ~8-10K this is typically 10% of the construction cost

- Construction cost 80-200K

What are your Financing Options?

It can be tricky to finance a granny flat. In fact, a lot of the major banks like Wells Fargo, Bank of America and Chase do not offer mortgage products to finance an accessory dwelling unit. Since this is typically a 6-figure investment most homeowners have a hard time paying for the whole thing in cash.

Read about How to Finance a Granny Flat and Loans Options

Most homeowners are forced into one of five options.

- Paying for it with cash or liquefying investments

- Home Equity Line of Credit

- Home Equity Loan

- Construction Loan

- Cash-Out Refinance

Is Building a Granny Flat a Good Lifestyle Fit?

Managing a tenant can be inconvenient and burdensome. Plus, building a granny flat comes with decreased privacy and often loss of yard space in exchange for passive rental income. When thinking about the original question, is a granny flat is a good investment? Also, consider the lifestyle fit by asking yourself these questions:

- Did you grow up with siblings?

- How much of your downtime is spent with friends?

- How relaxed are you with your material possessions?

- Are you happy to loan friends your things?

- How do you handle conflict? Would you rather keep things to yourself — or speak your mind?

- Have you lived with someone that isn’t a partner or loved one?

Case Study #1: Is a Granny Flat a Good Investment

Let’s explore two real houses and evaluate their investment potential.

House 1: Location, La Mesa, CA (a suburb of San Diego)

Lynn purchased this house in 1992 and has considerable equity in the home. On the property is a two-car garage with attached guest quarters.

A guest quarter is a bedroom + bathroom, no kitchen.

So there’s already a full bath in the guest quarters, which would save 10-15K in construction costs.

To convert her garage and guest quarter into a granny flat would cost her $60,000.

She plans to use 10,000 out of her savings and take out $50,000 from her home equity line of credit. She chooses an aggressive 3-year loan with an APR of 2.6%.

This means her monthly loan payments will be $1,440, but she plans to charge $1,650/mo for the apartment.

Within ten years she’ll have generated $185,000.

Data generated using the Break-Even Calculator

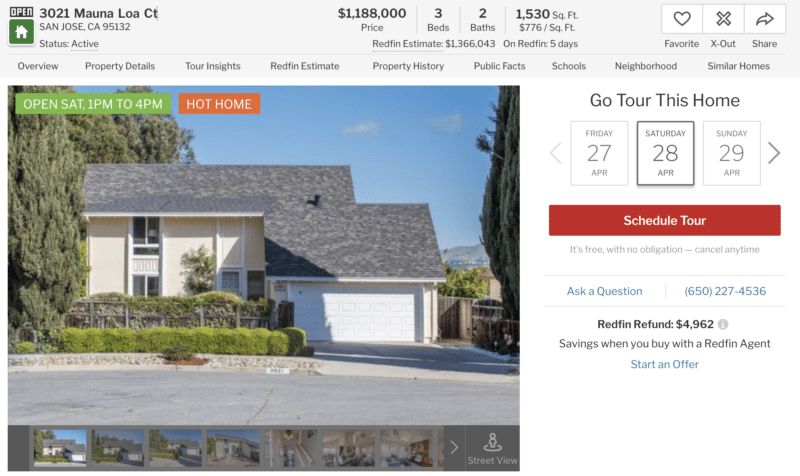

Case Study #2: Is a Granny Flat a Good Investment

Here’s a single-family home in San Jose, CA. It’s a four bedroom, two bathroom home for sale for 1.18 million. There’s enough room on the lot to build a stand-alone granny flat.

Construction cost estimate for a 550 square foot granny flat is $220,000.

It’s also estimated that completing this would add $420,000 in appreciation to the property and that the unit could rent for $2,500/month.

Rental price per square foot in San Jose is a ~$4 per square foot.

If the homeowners factored in the decision to build a granny flat with the purchase of their home they could increase the size of their loan when purchasing with the expectation that post-construction the value of the home will be much higher.

Reach out to Maxable to get a better idea of how investing in a granny flat could benefit YOUR property with a free ADU Planning Phone Call. Talk to you soon!