UPDATE, please read

As of December 9th, 2022, all funds for CalHFA’s $40,000 ADU Grant have been reserved. Applications have been closed.

However, with bill AB 157 CalHFA is being required to convene a working group to develop recommendations to assist homeowners in qualifying for loans to construct ADUs and JADUs on their property and to increase access to capital for homeowners interested in building ADUs. They have until July 1st, 2023 to prepare this working group.

Stay tuned and subscribe to our newsletter to get the latest updates!

California homeowners, the state wants to pay you $40,000 to build an accessory dwelling unit with this CalHFA ADU grant!

The California Housing Finance Agency—CalHFA—is offering a $40,000 grant to augment your ADU construction or renovation loan. A grant is money you don’t have to repay.

We’re thrilled about this brand-new ADU financing program. As it gains momentum, we think it’s going to make a big difference for homeowners who qualify. Along with Freddie Mac’s new ADU finance options, it’s proof that both the state and federal governments are getting serious about helping homeowners finance ADUs.

If you’d like to investigate the ADU potential of your property, hop on an ADU planning phone call with us. We’ll connect you with lenders, designers, and general contractors who specialize in accessory dwelling units. With ADUs, experience matters.

How the $40K CalHFA ADU grant works

The $40,000 CalHFA grant works in conjunction with a construction- or renovation-type loan. If you have enough cash to build an ADU without taking out a loan, that’s fantastic! But you will not be eligible for this grant.

The $40,000 CalHFA grant works in conjunction with a construction- or renovation-type loan. If you have enough cash to build an ADU without taking out a loan, that’s fantastic! But you will not be eligible for this grant.

Different lenders have different names for construction- and renovation-type loans, but the important thing is that the loan has a managed escrow, where the lender releases funds when different construction phases of the ADU are completed.

Lenders require a fixed-price proposal from a general contractor in order to approve a construction or renovation loan. General contractors usually won’t give you a fixed-price proposal without construction drawings, so you’ll need to have an ADU design that includes those drawings before you apply for the loan.

CalHFA determines your eligibility for the grant based on the same criteria your lender uses to approve you for your loan. Your lender will probably be able to tell from your loan application whether you’ll be eligible for the ADU grant, and your lender will apply for it.

Who qualifies for CalHFA’s ADU grant?

The grant is intended to help low- and moderate-income homeowners build ADUs. To qualify, you must own and live in the primary house.

- You will have to sign an affidavit certifying that you currently occupy the house.

- The deed must be under your name.

- You must occupy the house while the ADU is being constructed.

- The loan is not for investors. You must be the homeowner and currently living in the house.

So where can I get my $40,000?

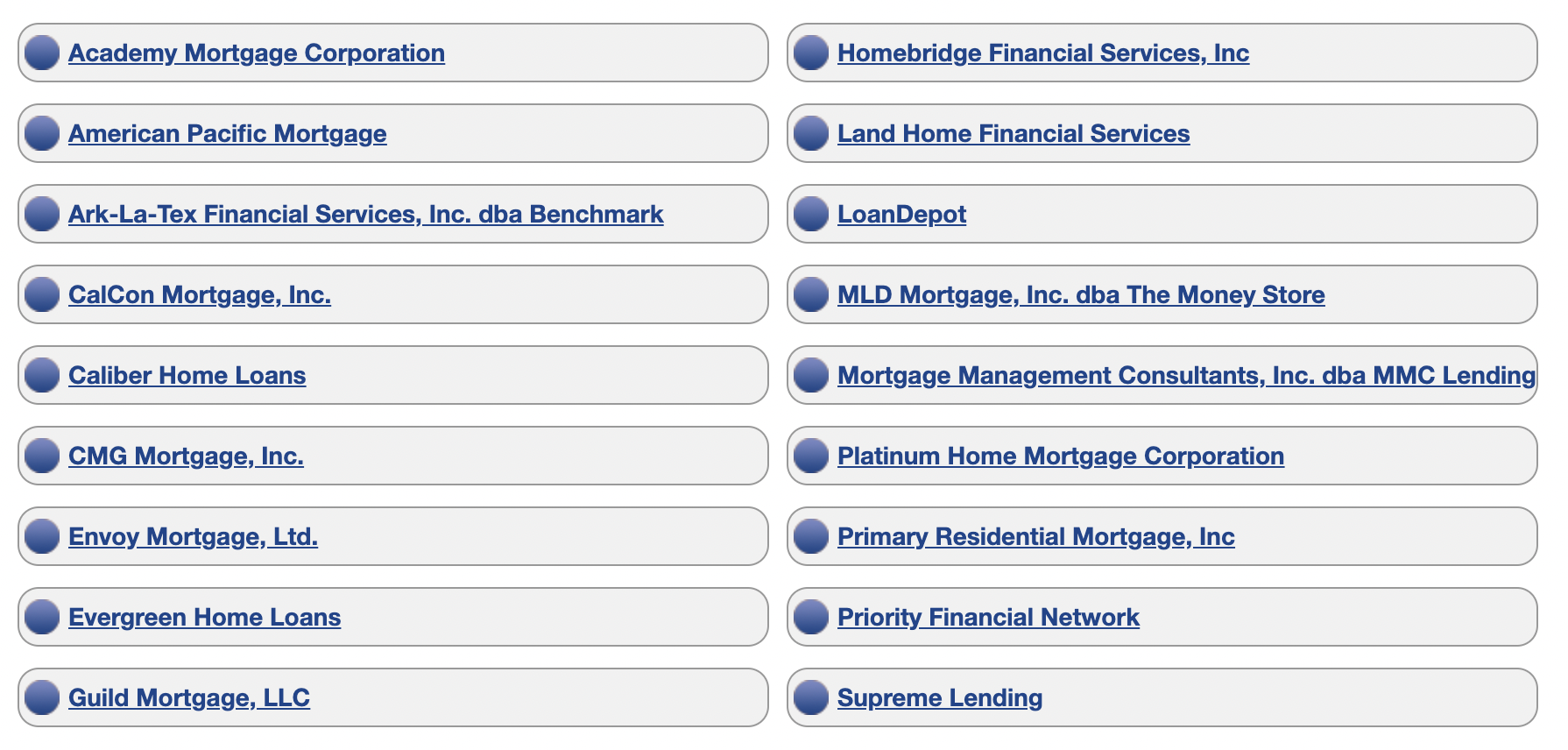

Right now, you can only get the grant if you obtain a loan from a CalHFA-approved lender. See below.

CalHFA is in the process of expanding the ADU grant program to more lenders as well as to cities, counties, credit unions, and redevelopment agencies that support ADUs. If you’re working with one of these organizations, be sure to ask about the $40K ADU grant because it may soon become available.

There’s a small catch

Almost all of the lenders approved by CalHFA are requiring you to refinance your mortgage. This is bad news for people that refinanced and locked in amazingly low rates last year.

The good news is that Maxable has the inside scoop on a few lenders that are taking a second position on the loan, which means you won’t have to refinance. Just keep in mind that this comes with its own requirements:

- You must take out a loan of at least $200K

- You must have at least 25-35% equity on your home

- Your loan rate will be 6-8%

- Your GC bids must be formatted in an appropriate way

You can book a call here with an ADU Agent and we can help connect you to an approved lender based on your needs.

Income limits

The people at CalHFA are well aware of California’s high cost of living. Their definition of “moderate income” reflects this, so don’t be put off if you think your income may be too high to qualify.

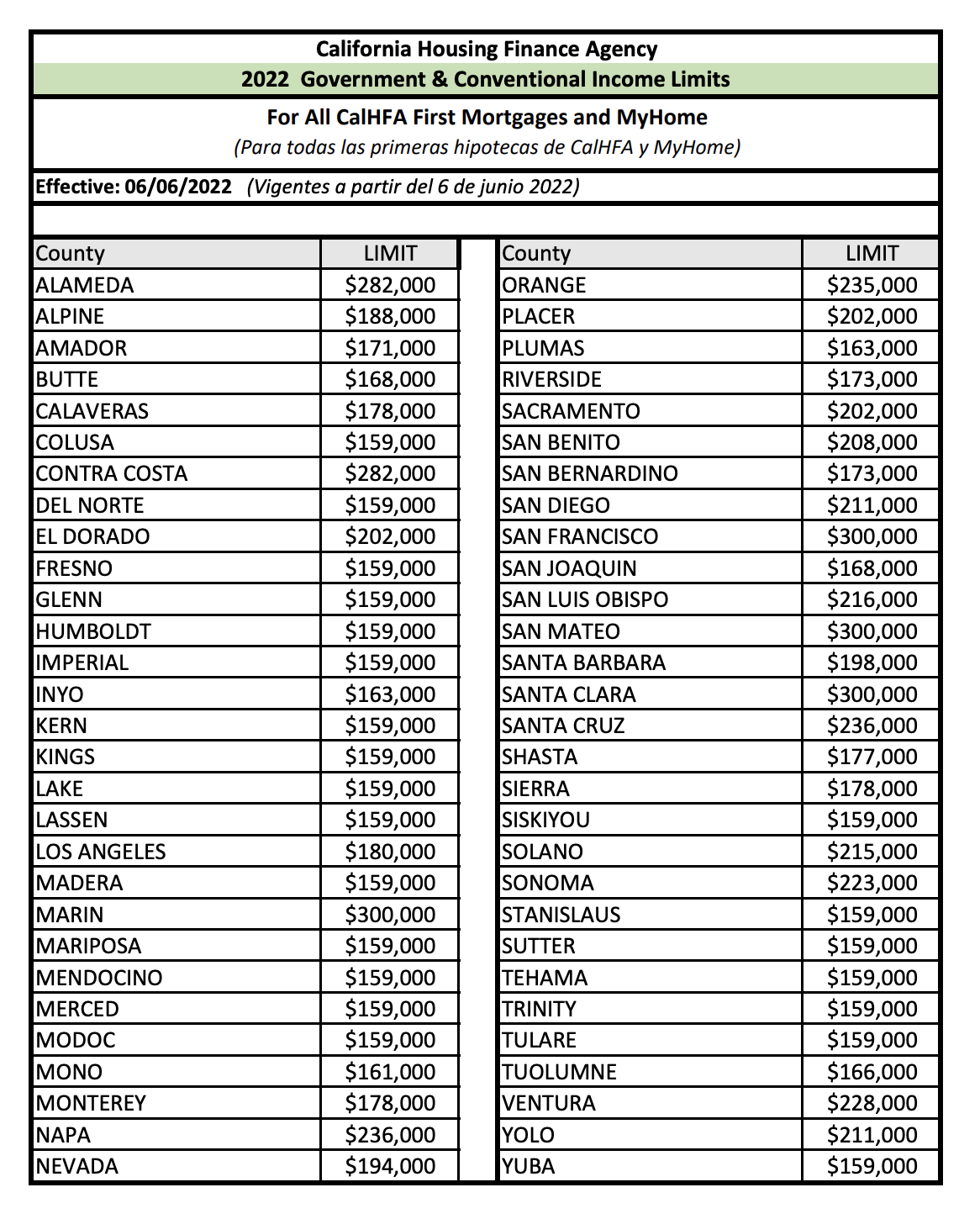

The income limits for the grant vary across the state. For example, in Yuma County the upper limit for annual income of the borrower is $159,000, while in Marin County it’s $300,000. Check your limit on this list below, updated in June 2022.

*UPDATE: If you are married and file taxes with your spouse, lenders will look at you and your spouse’s combined income, not just the income of the borrower applying for the grant. However, extended adult family members are excluded.

Costs the CalHFA ADU grant will cover

The CalHFA ADU grant is strictly for pre-development costs, also called soft costs. These include things like:

- architectural designs

- development impact fees

- permits

- property surveys

- soil tests

- energy reports for the ADU

- engineering and other reports specific to the ADU

- site prep (for instance, removing trees)

These items can add up! It’s especially great news that the grant covers development impact (DI) fees. In California, you don’t have to pay DI fees if your ADU is less than 750 square feet, but if it’s larger than 750, the DI fees can be as high as $10,000.

More good news: if your soft costs end up being less than $40,000, you can apply the excess funds to buying down the interest on your loan and to other non-recurring closing costs. So not a penny of the $40K will be wasted.

CalHFA will add the $40K to the money your lender has approved, and it will be released to pay for these soft costs. You won’t get a personal check for $40,000; all the money is distributed through your lender.

The CalHFA ADU grant does not pay for construction materials or labor

The CalHFA grant will not pay for any hard construction costs, which are the materials (lumber, cement, etc.) and labor used to construct the ADU. But $40,000 to cover soft costs means that many homeowners will get all those fees, reports, and services for free.

Sometimes general contractors will include soft costs in their itemized proposal, especially if you’re working with a design/build company. In these cases, the contractor and the lender will decide which of the costs can be covered by the grant money.

Can I get reimbursed for soft costs I paid out of pocket before I got my grant?

No, but keep those receipts. That amount can be applied by your lender to reduce the principal on the loan.

Are there other limits on the ADU?

Once the ADU is built, you can use it for anything you like and rent it to whomever you want. Neither the state nor the lender will be involved in any way. There’s only one rule: the ADU cannot be used as a short-term rental.

Will the CalHFA ADU grant money be taxed?

You will receive a 1099 for the grant money, and you should ask your accountant or a tax professional how this might impact your taxes for the year.

Plan your ADU with a Maxable expert

Plan your ADU with a Maxable expert

Financing is the first step in any ADU project. As interest rates shift, it’s important to connect with lenders who are experienced with ADU financing and who keep on top of all the recent developments.

Case in point: Rental income from a proposed ADU can now—finally!—be counted toward your qualifying income for an ADU loan. This is huge!

Maxable’s lending partners have been financing ADUs for years and know all the best strategies to get you the loan you need to build your accessory dwelling unit. When you’ve got your funds lined up, Maxable will match you to an experienced ADU designer and a local, vetted contractor. After 300 completed ADUs, we’ve got you covered!

Check your address to get connected, and start making your ADU dreams a reality today!