Update as of July 6th, 2023

The government has approved an additional $50 million for CalHFA to use towards ADU initiatives. It is currently not known what CalHFA will use the funding for, but it could be to begin their $40K ADU Grant program again.

Enter your email below to receive updates.

Update as of February 23rd, 2023

CalHFA will be reopening their ADU Grant portal to accept new reservations on Wednesday, March 1st, 2023, 9am PST.

Some things to note about the grant:

- CalHFA has not disclosed how many reservations will be available

- Reservations will be on a first-come-first-serve basis

- The grant required 100% of the construction budget to be in escrow

- The grant is taxable on the FULL amount

- The grant is withheld until you receive your permits

UPDATE as of December 9th, 2022

As of December 9th, 2022, all funds for CalHFA’s $40,000 ADU Grant have been reserved. Applications have been closed.

However, with bill AB 157 CalHFA is being required to convene a working group to develop recommendations to assist homeowners in qualifying for loans to construct ADUs and JADUs on their property and to increase access to capital for homeowners interested in building ADUs. They have until July 1st, 2023 to prepare this working group.

Original blog continues below

Everyone has been buzzing about the CalHFA ADU grant that was announced just a few weeks ago. Sounds amazing right? Free money to build your ADU that you don’t have to pay back? Sign us up!

Unfortunately, a lot of homeowners were turned off from the grant due to the requirement that you had to refinance your mortgage, especially since so many people refinanced last year and got AMAZING rates. (We’re talking rates as low as 2.25%!)

Thankfully, CalHFA listened and is now offering new options that eliminate the need to refinance AND you no longer need to take out a loan. Let’s dive in.

CalHFA ADU grant updates

The biggest update for this grant is that you no longer have to take out a loan to receive this grant. Great news for people that are paying in cash!

How does it work?

CalHFA has added several non-profits to their list of approved entities that can help you apply for the grant. Several of these nonprofits will allow you to create a managed account, or escrow account, through a third party that is licensed and bonded as a fund control.

These non-profits will submit the application for you and once you are approved, the grant will be added to the managed account.

The reason for the managed escrow account is to prevent fraud: the state needs to make sure people who are getting the $40K are actually using it to build an ADU. The funds—yours and the $40K grant—will be released as your ADU project reaches different milestones. But you, not the third party, will sign off on each dispersal. You will be in control of your funds.

If you’re not using a construction loan, a HUD Certified Inspector will oversee the project and come by the construction site now and then to confirm that, yes, you’re really building an ADU.

If you are using a construction loan, the bank oversees the phases of construction and disperses the funds.

Quick recap of the CalHFA ADU Grant

With interest rates rising, CalHFA recognized the need to alleviate some of the costs involved with building an ADU. Initially, this grant started at just $25K per applicant but was later increased to $40K. CalHFA sweetened the pot even more by adding an additional $50 million to the grant pool, bringing the grand total to $100 million.

That means approximately 2,500 people will get this grant.

Requirements for the CalHFA ADU grant

The rest of the requirements for obtaining the grant are still the same

Income Limits

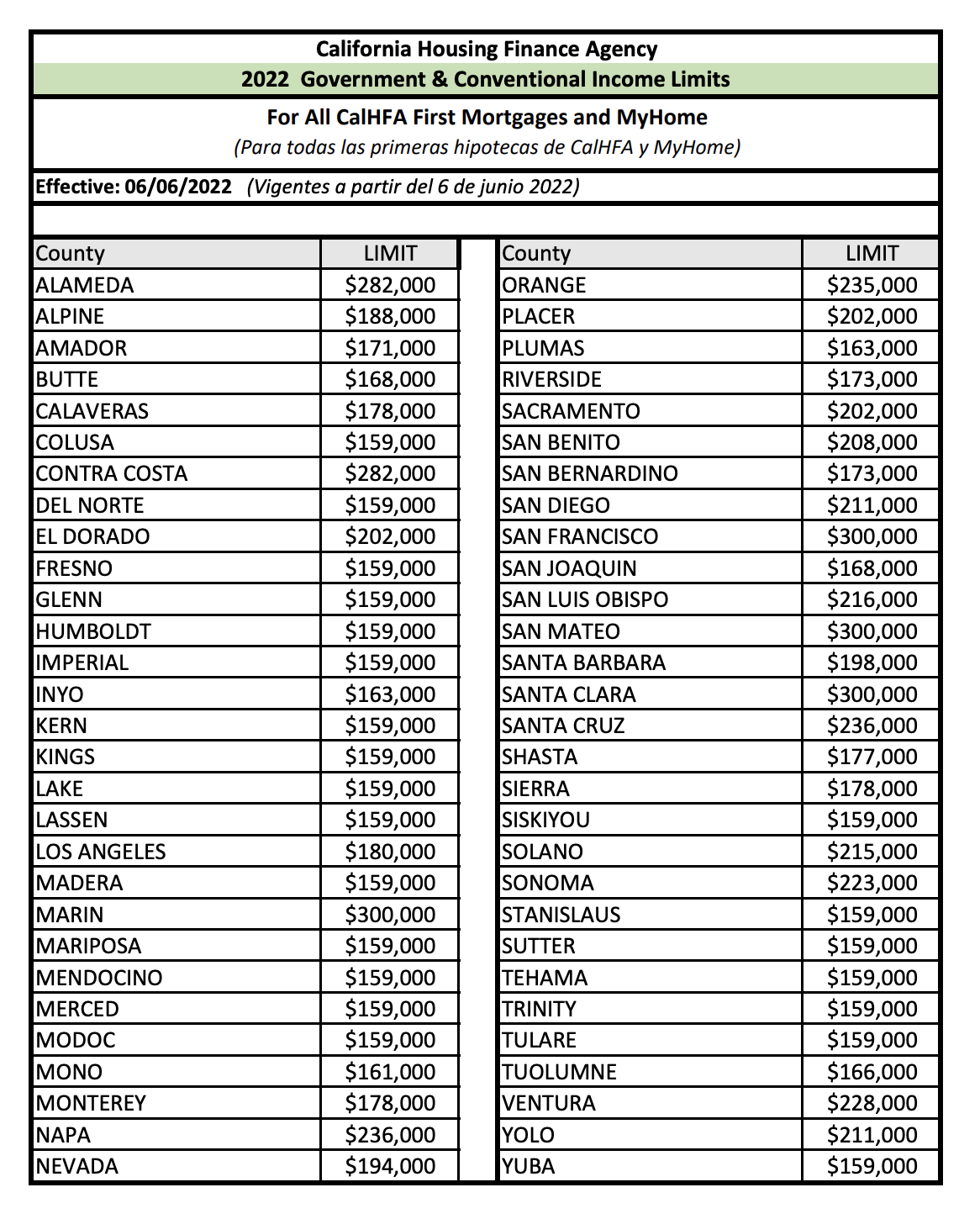

The people at CalHFA are well aware of California’s high cost of living. Their definition of “moderate income” reflects this, so don’t be put off if you think your income may be too high to qualify.

The income limits for the grant vary across the state. For example, in Yuma County the upper limit for annual income of the borrower is $159,000, while in Marin County it’s $300,000. Check your limit on this list below, updated in August 2022.

*UPDATE: If you are married and file taxes with your spouse, lenders will look at you and your spouse’s combined income, not just the income of the borrower applying for the grant. However, extended adult family members are excluded.

What does the CalHFA ADU grant cover?

The CalHFA ADU grant is strictly for pre-development costs, also called soft costs. These include things like:

- architectural designs

- consulting costs

- development impact fees

- permits

- property surveys

- soil tests

- energy reports for the ADU

- engineering and other reports specific to the ADU

- site prep (for instance, removing trees)

These items can add up! It’s especially great news that the grant covers development impact (DI) fees. In California, you don’t have to pay DI fees if your ADU is less than 750 square feet, but if it’s larger than 750, the DI fees can be as high as $10,000.

The grant will not cover construction, material, or labor costs.

Other requirements?

The grant is intended to help low- and moderate-income homeowners build ADUs. To qualify, you must own and live in the primary house.

- You will have to sign an affidavit certifying that you currently occupy the house.

- The deed must be under your name.

- You must occupy the house while the ADU is being constructed.

FAQs for the CalHFA ADU grant

What if I still need a loan but I don’t want to refinance to get the ADU grant?

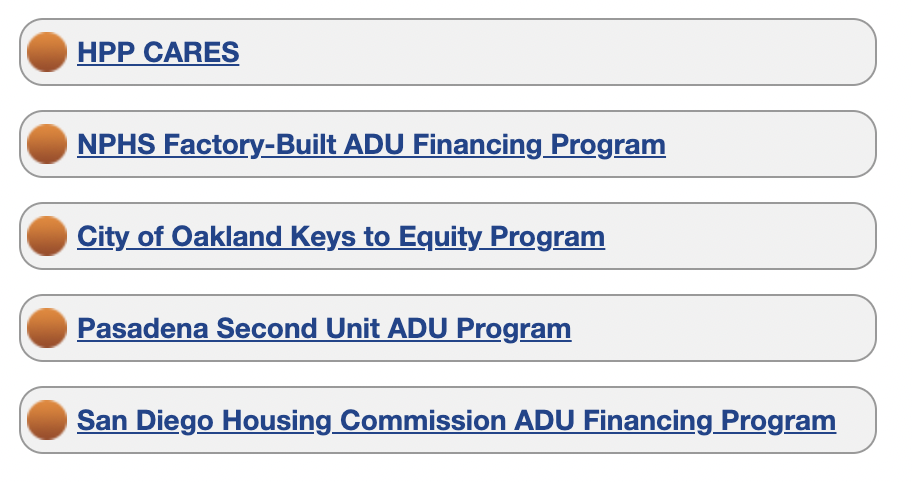

Several of the non-profits on CalHFA’s approved list have partnered up with lenders that will not require you to refinance your mortgage to apply. You can view some of the non-profits below.

There is also one lender on the approved lender list that will take a second position on the loan and will not require you to refinance. However, there are some requirements with this lender as well:

There is also one lender on the approved lender list that will take a second position on the loan and will not require you to refinance. However, there are some requirements with this lender as well:

- You must take out a loan of at least $200K

- You must have at least 25-35% equity on your home

- Your loan rate will be 6-8%

- You must use a general contractor from their approved list

Can an investor access the CalHFA ADU grant?

At this time, the answer is no, but with CalHFA making so many updates, we wouldn’t be surprised if this is something that is made possible in the future.

Is the CalHFA ADU grant taxable?

Yes, the full amount of the CalHFA ADU grant is taxable.

Do I need a proposal from a contractor to get the loan for the grant?

Lenders require a fixed-price proposal from a general contractor in order to approve a construction loan (sometimes called a renovation loan). General contractors usually won’t give you a fixed-price proposal without construction drawings, so you’ll need to have an ADU design that includes those drawings before you’re approved for a construction loan.

CalHFA determines your eligibility for the ADU grant. This is based on the same criteria your lender uses to approve you for your loan. Your lender will probably be able to tell from your loan application whether you’re eligible for the ADU grant, and your lender will apply for it.

How long do I have to apply for the CalHFA ADU grant?

With the improvements that CalHFA has made to their grant program and since there is a limited amount in the grant pool, we estimate that this grant will be gone by the end of 2022, so we recommend kickstarting your project soon!

This grant is only available to the first 2,500 people and 200 have already secured their grant money. It’s going fast!

Hop into an ADU Planning Call with an ADU Agent to get started on your ADU project and lock in your $40K for your project. Your ADU Agent will walk through your ADU ideas and goals with you. Once you feel ready, you’ll be matched with an ADU designer in your area.